2022 passenger car registrations in the Netherlands

Passenger cars registrations keep going down while the average base price of models registered keeps going up. The registrations of battery electric vehicles for the third year in a row stabilized at around 70 thousand. Most striking is the ‘collapse’ of registrations of vehicles with an internal combustion engine with . That, in short, is the summary for the 2022 passenger car market.

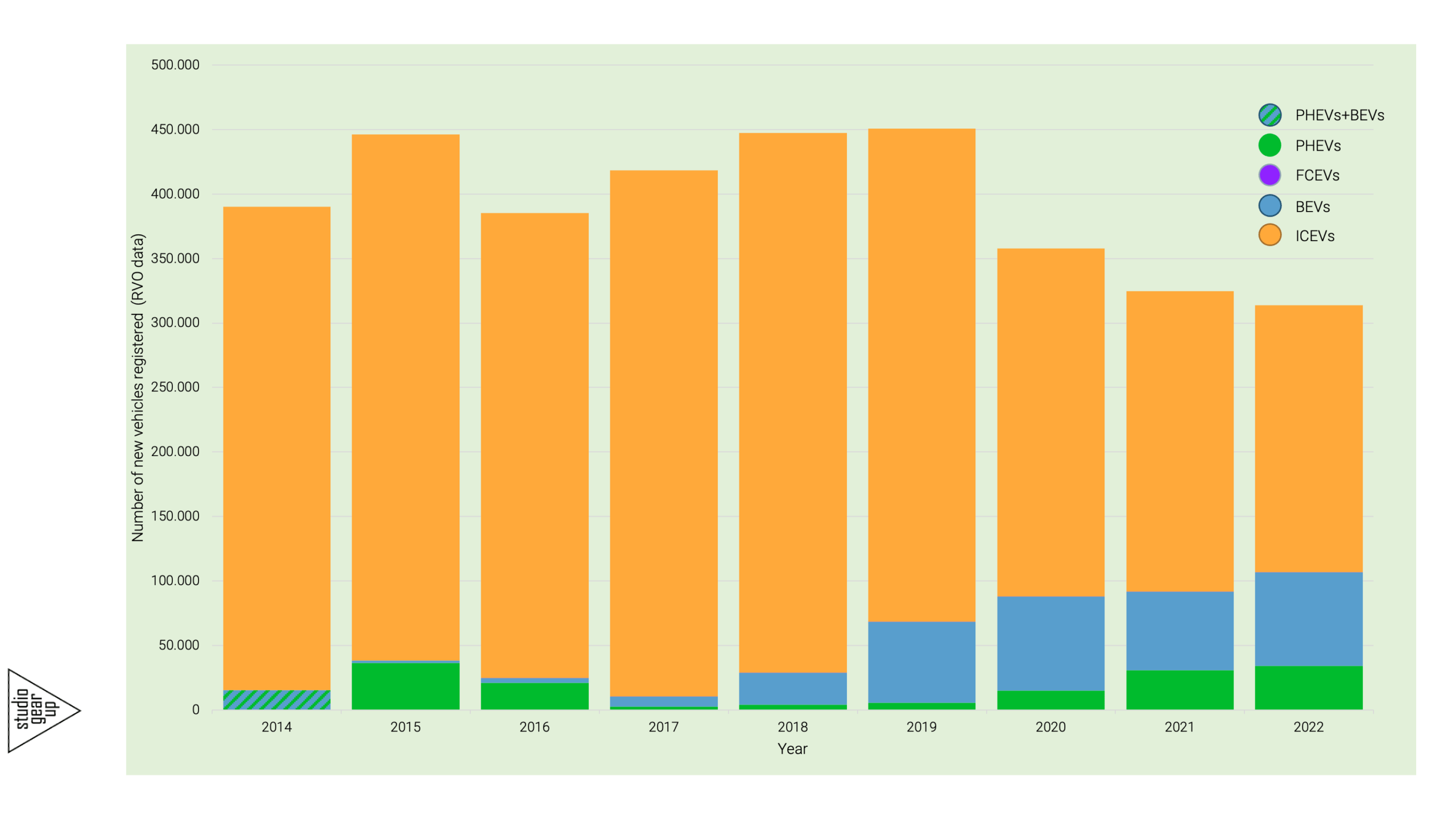

In 2022 in total 312 thousand new passenger cars were registered in the Netherlands. For three years in a row now the registration numbers have dropped. Figure 1 shows the overall development. The number of registered ICEV was with 206 thousand 26 thousand less than the year before, and less than half of the recent peak of 418 thousand in 2018.

From the diagram below one can not conclude that BEV and PHEV are taking over, though expressed in percentages they make really great numbers: 23% of all registrations is an Battery Electric Vehicle (BEV), 11% is a Plug-in Hybrid Electric Vehicle (PHEV) and only 66% is an Internal Combustion Engine Vehicle (ICEV). No, it’s the ICEV that no longer is bought. Let’s look deeper.

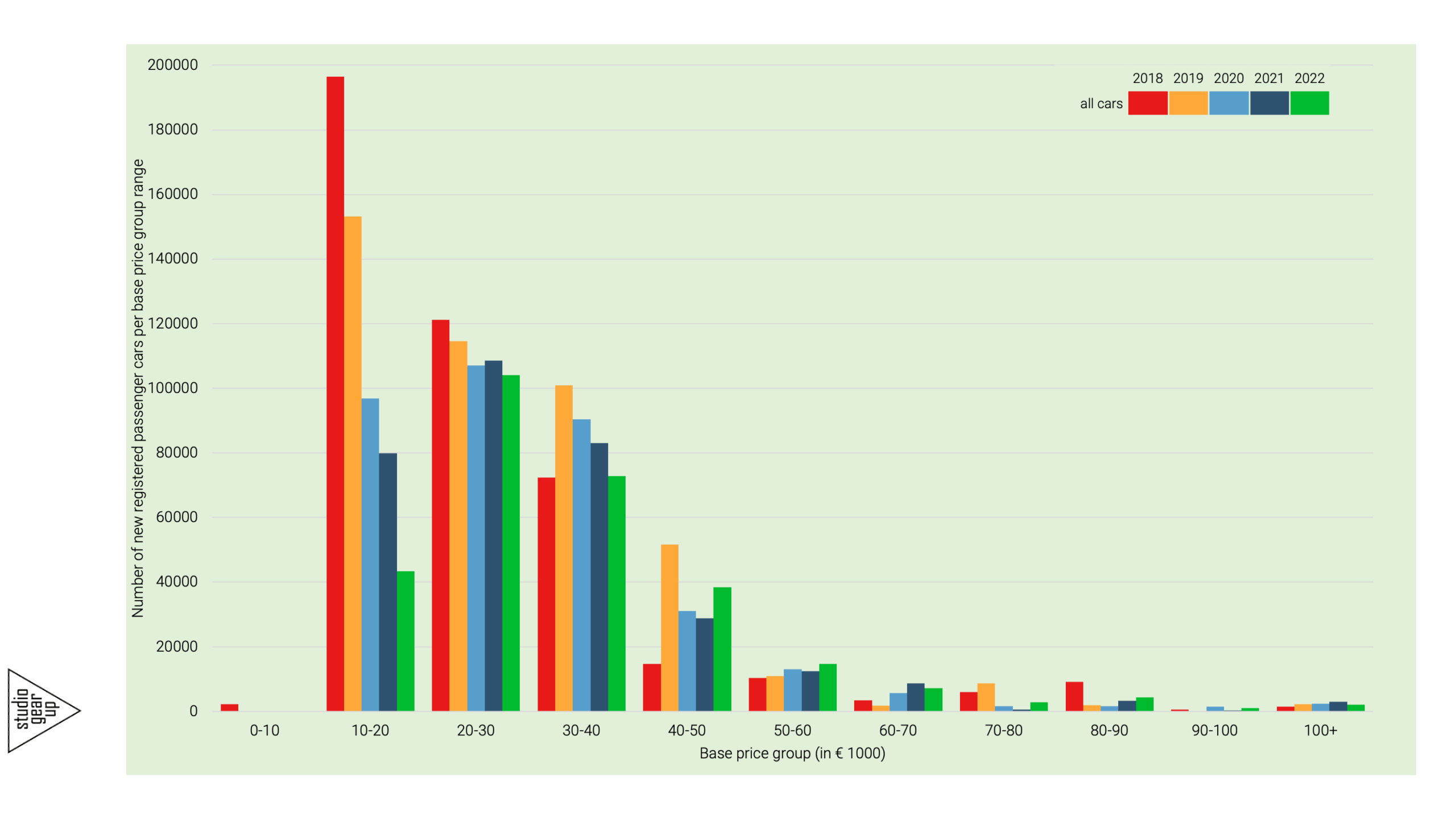

When comparing the registration volumes of the passenger cars in the various base-price ranges, it becomes more visible what is happening. In Figure 2 the registrations volume per base-price range (10-20k€, 20-30 k€, 30-40k€, etc.) is presented for the years 2018-2022.

In 2018 almost 200 thousand passenger cars where sold with a base price between 10 and 20 thousand euro (10-20k€), and they represented also the largest volume, compared to all other base price ranges (see the red bars). Another 120 thousand passenger cars were registered with a base price between 20-30 k€. To compare: these two ‘low’ base-price categories represent the same number of vehicle registrations as the total of 2022! And in 2022 (the green bar) most vehicles were sold in the 20-30k€ range (100 thousand cars), with the runner-up group being he cars in the 30-40k€ range (± 70 thousand).

Most striking is free-fall for vehicles registration in the lowest base-price range of 10-20k€. from nearly 200 thousand registrations in 2018, down to just about 40 thousand in 2022, a decrease of nearly 80%. One possible explanation for this may be that households that in earlier years did buy a new car car (mostly A-class or B-class types of vehicles), now switch to the second hand market. Another explanation could be that the car manufacturers are increasing prices so that the low cost models move upward and ‘switch’ price groups. An example of such development is the VW Polo: in 2018 the base-price was € 15,375 which grew in 2022 to € 21,000, making the Polo ‘jump’ from the 10-20k€ range to the 20-30k€. What one would expect though in the case, is that the numbers in this price-range group would grow, and Figure 2 shows that that is not to case, also not in the range of 30-40k€. So it seems reasonable to believe that the appetite of buyers of new passenger cars in the low cost price range has diminished. In turn the appetite for more expensive crass increasing: n the range of 40-50k€ and also in the range of 50-60 k€ registrations numbers went up in 2022.

How did EVs perform in 2022?

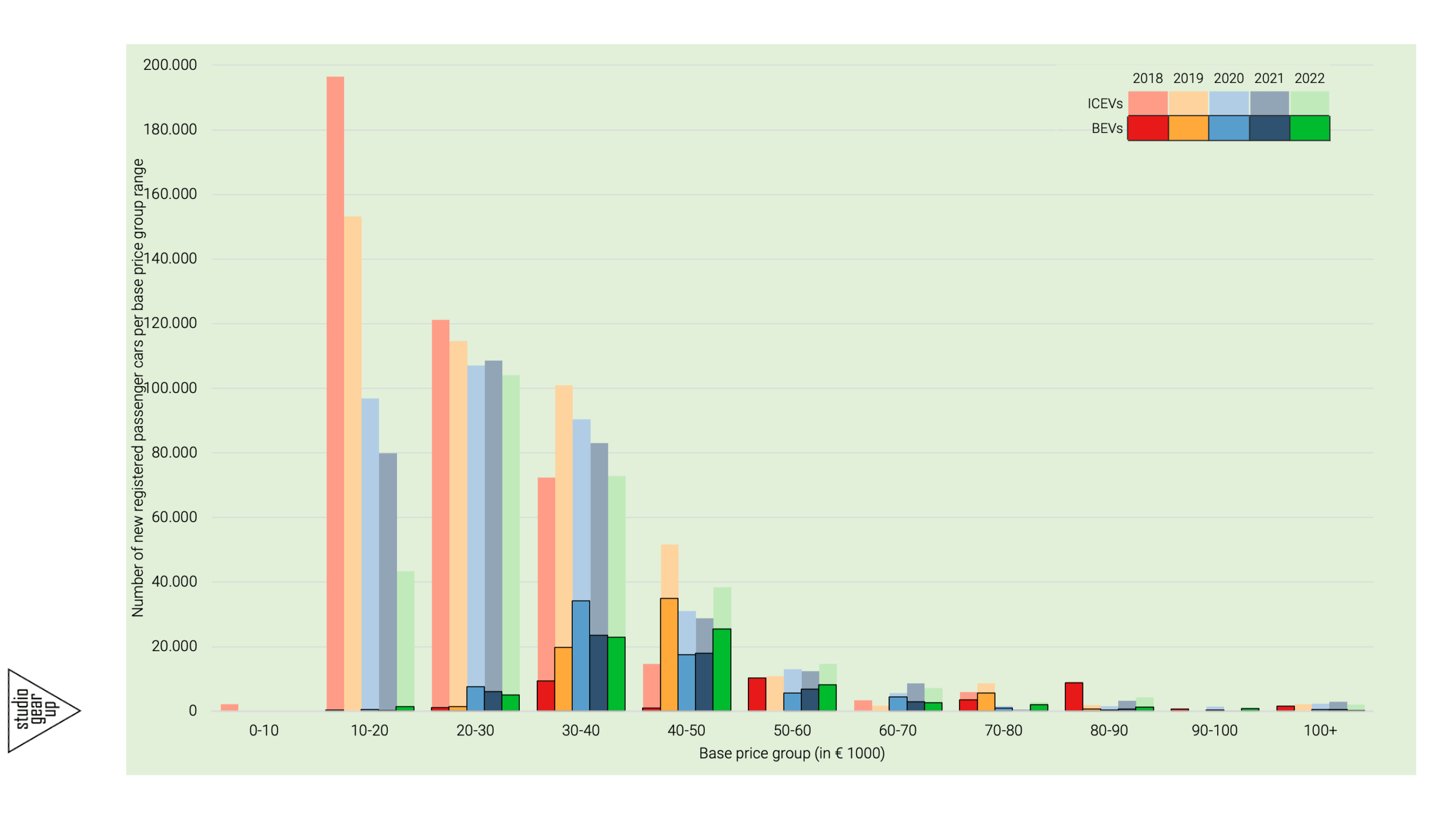

To understand how full electric vehicles (BEVs) performed we have to turn again the the Figure with the registration numbers per base-price range. please note that we have checked for each vehicle model with more than 100 registrations what is the lowest price the model was available for. The actual purchase price can sometimes be significantly higher, due to the addition of all kinds of accessories. In Figure 3, the BEVs are plotted in the same figure as shown in Figure 2. The bright bar colors indicate the share of BEVs in the range.

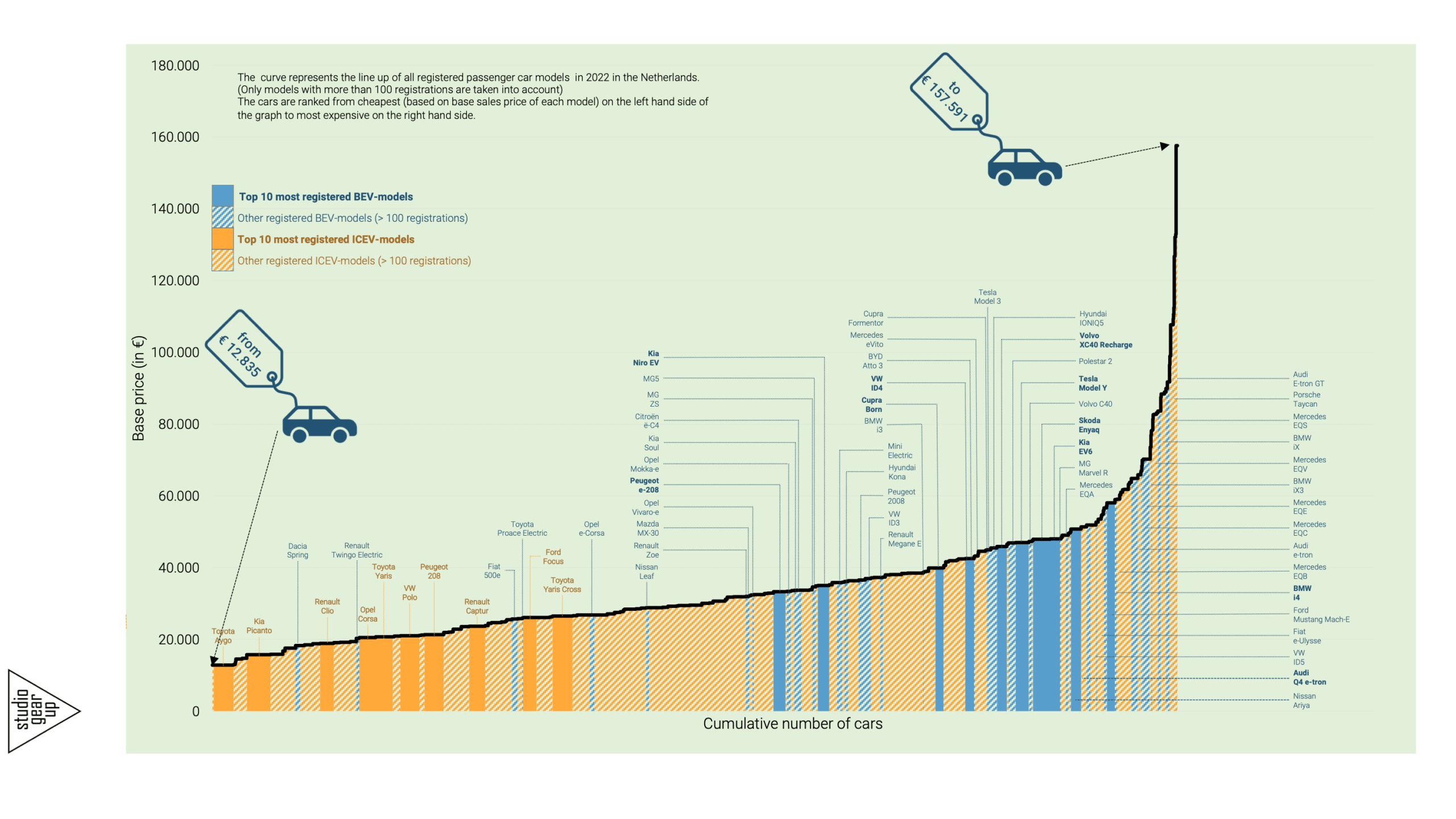

Most BEVs in 2022 were in the base-price range of 40-50 k€ (green bar). In 2021 most BEVs were still in the 30-40 price range (dark blue bar). In 2022, both in the 40-50k€ and in the 50-60k€ the share of BEVs in total registration in that price range was wel above 60%. their presence in the lower price range of 20-30€ is still very low. This is also illustrated by the next Figure. In the diagram all registered passenger cars are ranked on basis of their base-price: the vehicles with the lowest base price on the left hand side of the graph and the ones with the highest base price on the far right side of the graph. The orange coloured are all ICEVs and blue represents the BEVs.

It can clearly be seen that the top 10 registered ICEV all are present in the left half, the lower base-price section of the diagram, whereas the BEV are, beside a few exceptions, are all concentrated in the right side, higher price range of the diagram.

And as we could see in Figure 3, only a limited number of low-cost (<30k€) BEVs are registered in the Netherlands. and that may impact in the near future the acceleration of the presence of BEVs in the total fleet of passenger cars. Unless BEVs are not appearing in the lower cost price ranges, the second hand market for affordable BEVs can’t materialize quickly enough. The current high-end prices BEVs will most probable not drip through to the low cost second hand market. They will most likely after the end of the business lease contract find their way to export countries for a second life as business car. And we might see, as a result, a constant number of such higher price vehicles in the market and only slow penetration of (new and second hand) low-cost BEVs in the passenger fleet.

In that respect it will be interesting to see how 2023 will enfold. Indications of the first months of registrations that total registration numbers rise, both for BEVs and for ICEVs. But the true breakthrough milestone for BEVs will be whether the share of BEV in the 20-30k€ range will rise far above the 2022-level of just 5%.

Notes and sources

Notes

[1] The analysis of the new registered passenger cars and the base-price information is based on several sources. See the list below. The assessment has been carried out for all newly purchased car models for which the number of registrations in 2023 on the Netherlands market were 100 or more. In total 222 models qualified for this threshold value. The total registrations of these vehicles accumulated to 291 thousand vehicles, which represented 93% of all new registered passenger cars (312 thousand) in the Netherlands in 2023.

Sources

RDW: open database; RVO: monthly statistical reports; BOVAG, website with monthly and annual sales number; Autoweek, website for model price information