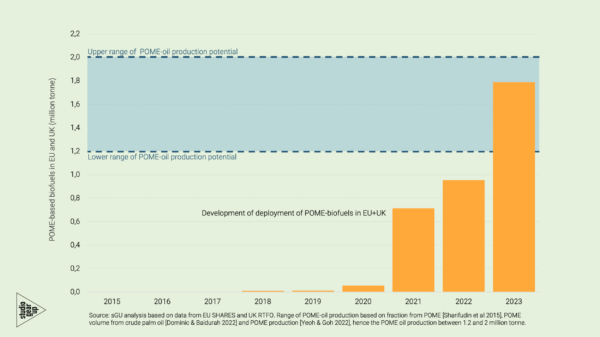

In 2023, 69% of all new registered passenger cars in the Netherlands carried an internal combustion engine, in most cases combined with some form of electric engine (either mild hybrid, full hybrid or plug-in hybrid). At the same time, 68% of the registered cars carried an electric engine (Figure 1). Five years ago, the situation was completely different, with almost complete dominancy of vehicles with a combustion engine. As Figure 1 shows, it seems that from 2024 onwards the share of newly registered vehicles with an electric engine will outnumber the vehicles with an internal combustion engine. The era of ICEV dominancy may have come to an end.

Figure 1. Development of the share in registrations of new passenger with an internal combustion engine and with an electricity drive train from 2018-2023. (Source data: BOVAG, RAI Vereniging, graph by studio Gear Up)

Electric drivetrain about to take over dominancy in annual registration numbers

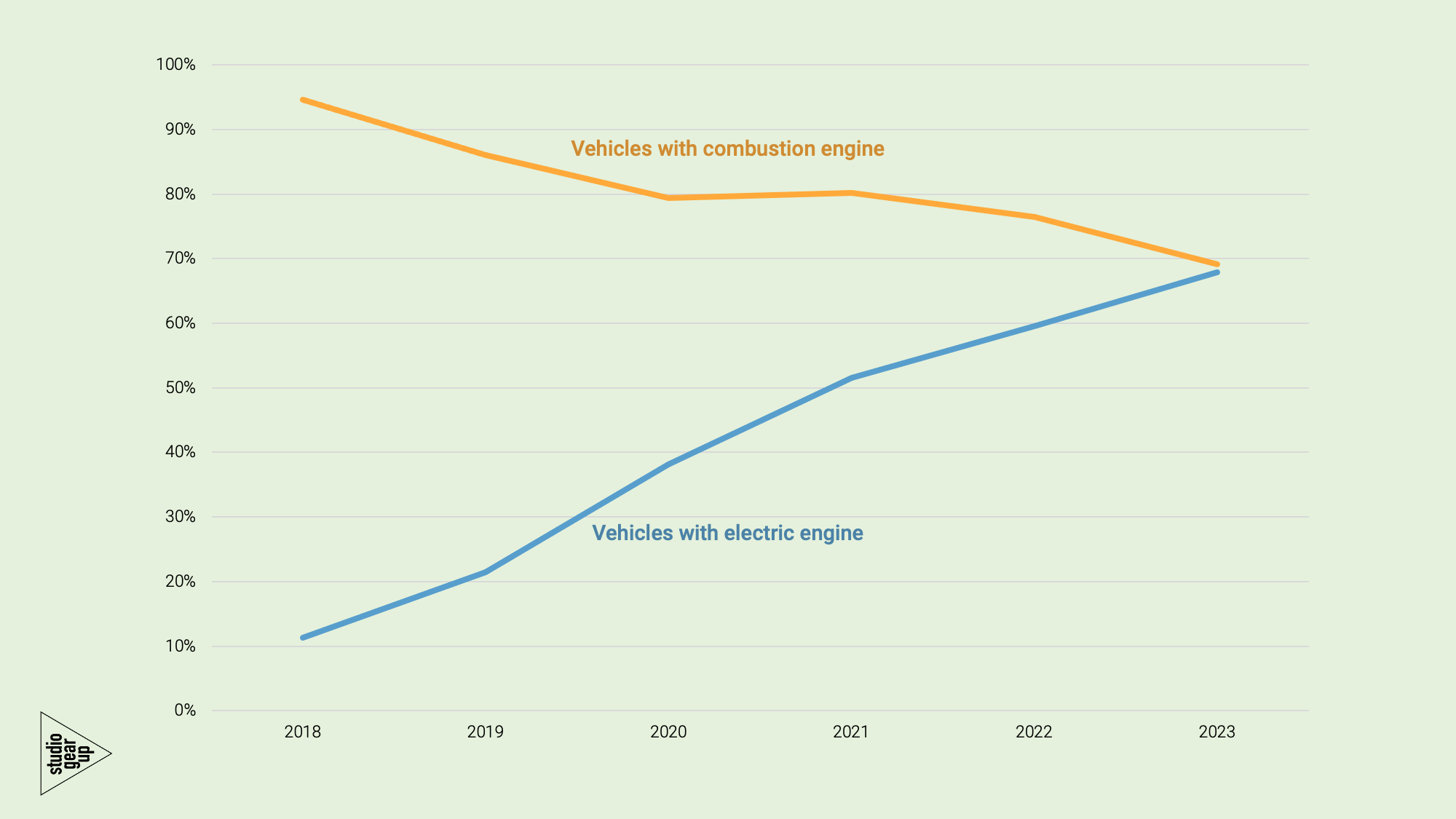

Figure 2 provides further detail on these numbers, indicating the various types of combustion engine only , hybrid drivetrains (mild hybrids, full hybrids, plug-in hybrids) and electric only. In 2023 44% of all registered passenger cars had a charging plug (i.e. the plug-in hybrid or full electric vehicles); in 2018 that share was less than 5% of total registrations. From Figure 2 it can also been seen (left graph) that the volume of combustion engine only vehicles is declining rapidly over the years, where the vehicles with electric engine have a steady and steep growth in the period 2018-2023, pushed by the ongoing growth volume of full electric vehicles.

Figure 2. Actual registration numbers (left) and relative share of registration (at right) of passenger cars in the Netherlands 2018-2023 (Source data: BOVAG, RAI Vereniging, graph by studio Gear Up)

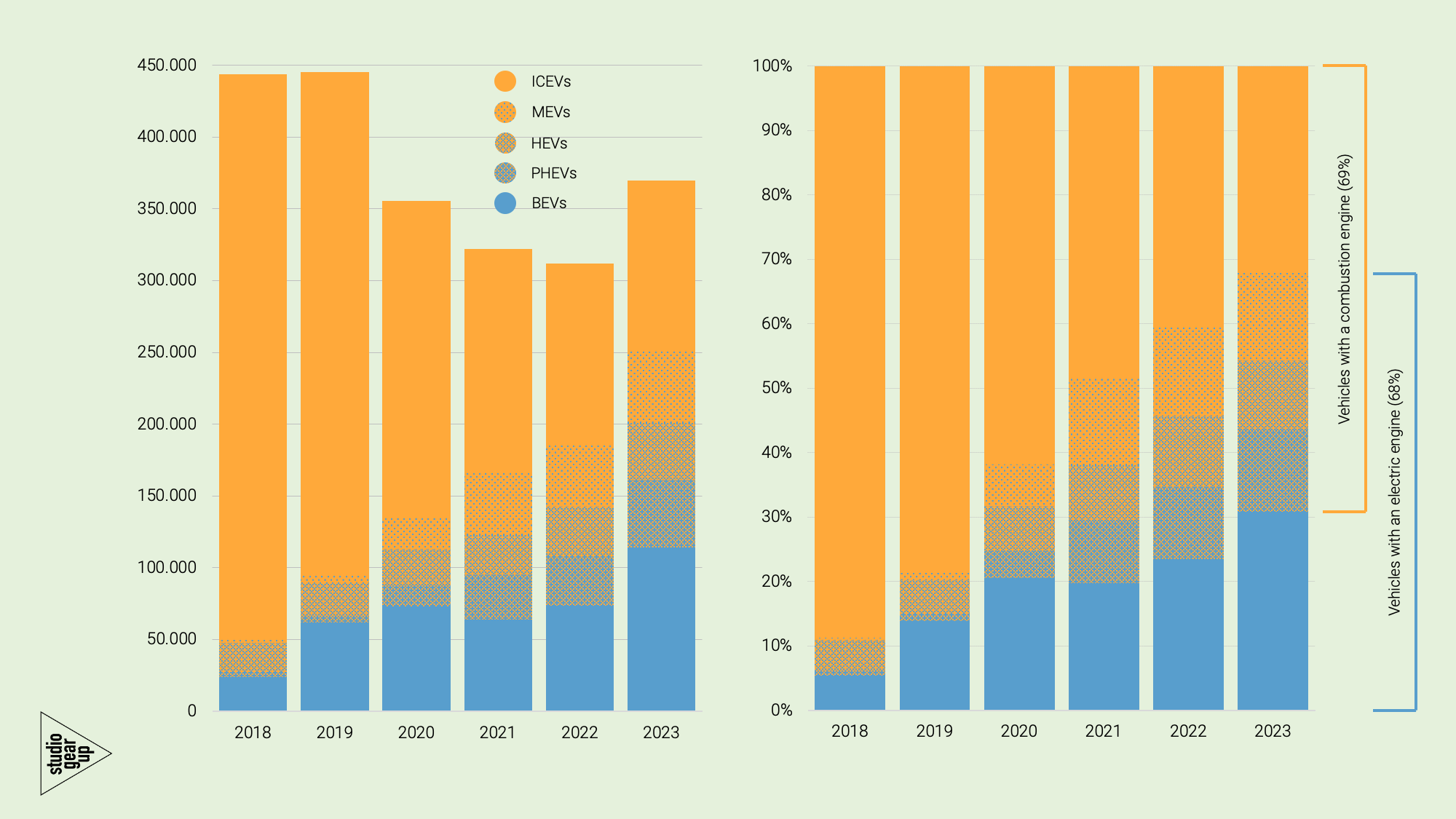

ICEVs still dominant in the passenger car fleet in the Netherlands

Dominancy of full electric vehicles (BEVs) in the total fleet is still to be awaited. End of 2023 the passenger car fleet totaled 9.1 million vehicles of which 436 thousand BEVs (4,7%) and 263 thousand PHEVs (2,9%) exists in the total fleet of 9 million passenger cars in the Netherlands (Sources: Netherlands Statistics, RVO). The target for 2030 is to achieve 1,6 million BEVs in the fleet. As the Netherlands policy is to allow from 2030 onwards only new registrations being full electric, it is expected that from 2030 onwards a gradual shift towards dominance of BEVs is expected. However, it may well be that the speed of reaching dominancy might depend to a large extend on the emergence of the 2nd hand market of BEVs, in the awareness that the current ICEV 2nd hand market is characterised by lower segment, lower cost and smaller vehicles, and it may be expected that customers that rely on purchasing second hand vehicles will stick to those types of vehicles, also being more often purchase budget constraint. In the next sections we analyse whether the current BEV-models would be, price wise, be in line with such possible future 2nd hand market demand.

Figure 3. Development of the passenger car fleet volume in the Netherlands, 2000-2023. (Source Netherlands Statistics (CBS), RVO. Graph by studio Gear Up

Further details on the 2023 new registrations:

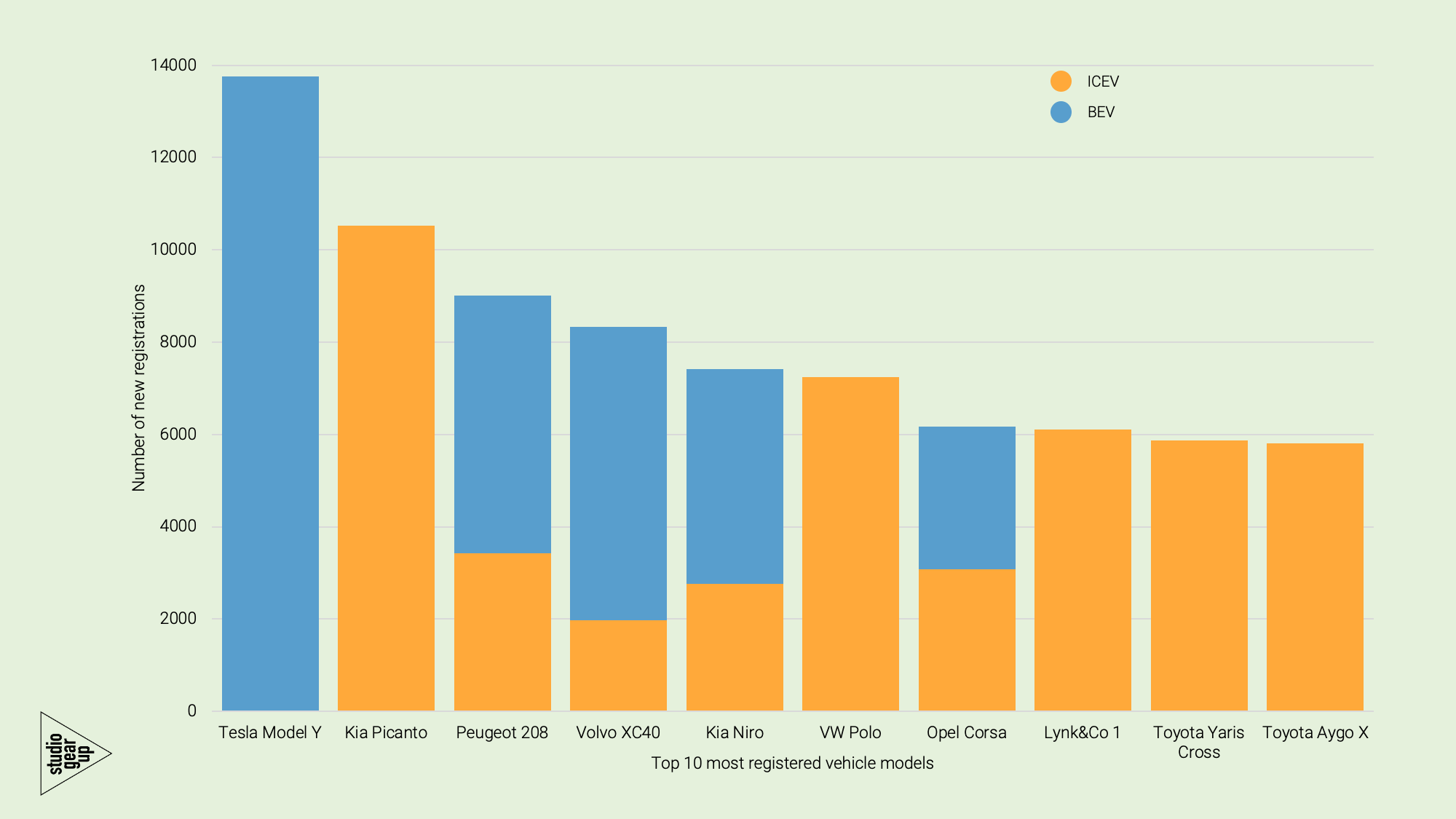

Tesla Model Y and Kia Picanto are the top selling models

The best-selling overall, and battery electric, vehicle model in 2023 in the Netherlands was the Tesla Model Y: 13.8 thousand, at a base sales price [1] of € 42,990, just below the ceiling of the BEV purchase subsidy and the business lease benefit limit.

The next best-selling overall model, and first in the category of vehicles with an internal combustion engine, was the Kia Picanto (10.5 thousand registrations, at a base sales price of € 16,465).

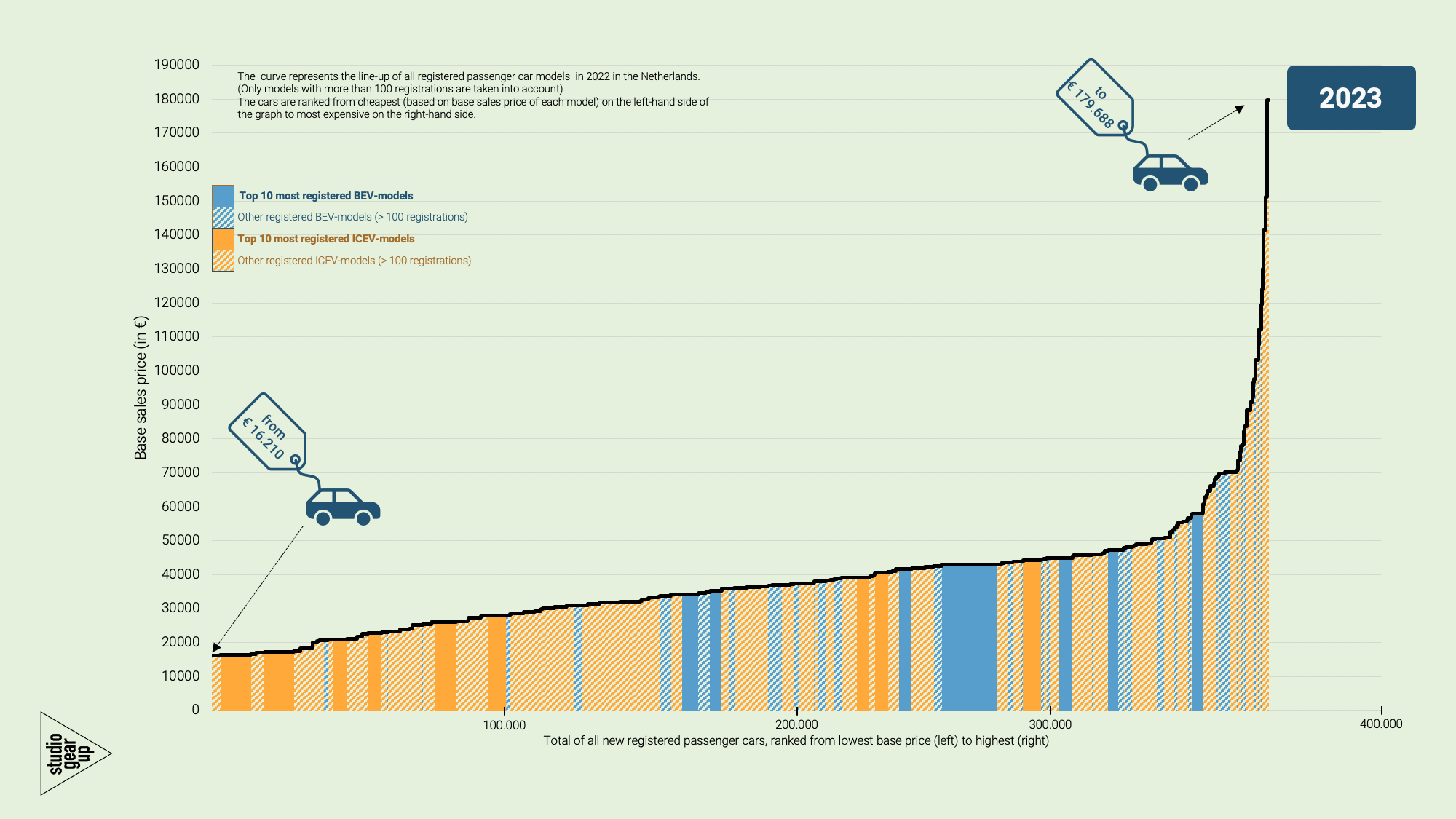

To some level the numbers of these two models are illustrative for the car buyer segments in the Netherlands: most of the Battery Electric Vehicles (BEVS) are sold for the business lease segment, whereas private customer stick to smaller, lower costs vehicles with combustion engines (ICEVs). This is visible in the next two diagrams, showing the top 10 of best-selling models (Figure 4) and the distribution of ICEV and BEV models sold, ranked on their base sales price.

Figure 5 shows that the large majority of BEVs registered are still at the higher priced, right hand side of the graph. This indicates that only very limited numbers of BEVs below € 30 thousand are sold, which will cause that the future second hand, used car market in the years to come still will consist of such higher segment vehicles.

Figure 4. Top ten models of passenger car registrations in the Netherlands, 2023. Source: RDW, RVO. Graph by studio Gear Up

figure 5. Ranking of ICEVs (orange) and BEVs (blue) in total sales numbers (horizontal axis) and base sales price (vertical axis). Top 10 models of each category presented in full colour. Source: RDW, RVO, Autoweek. Graph by studio Gear Up.

In what base sales price range are newly registered vehicles grouped in 2018-2023?

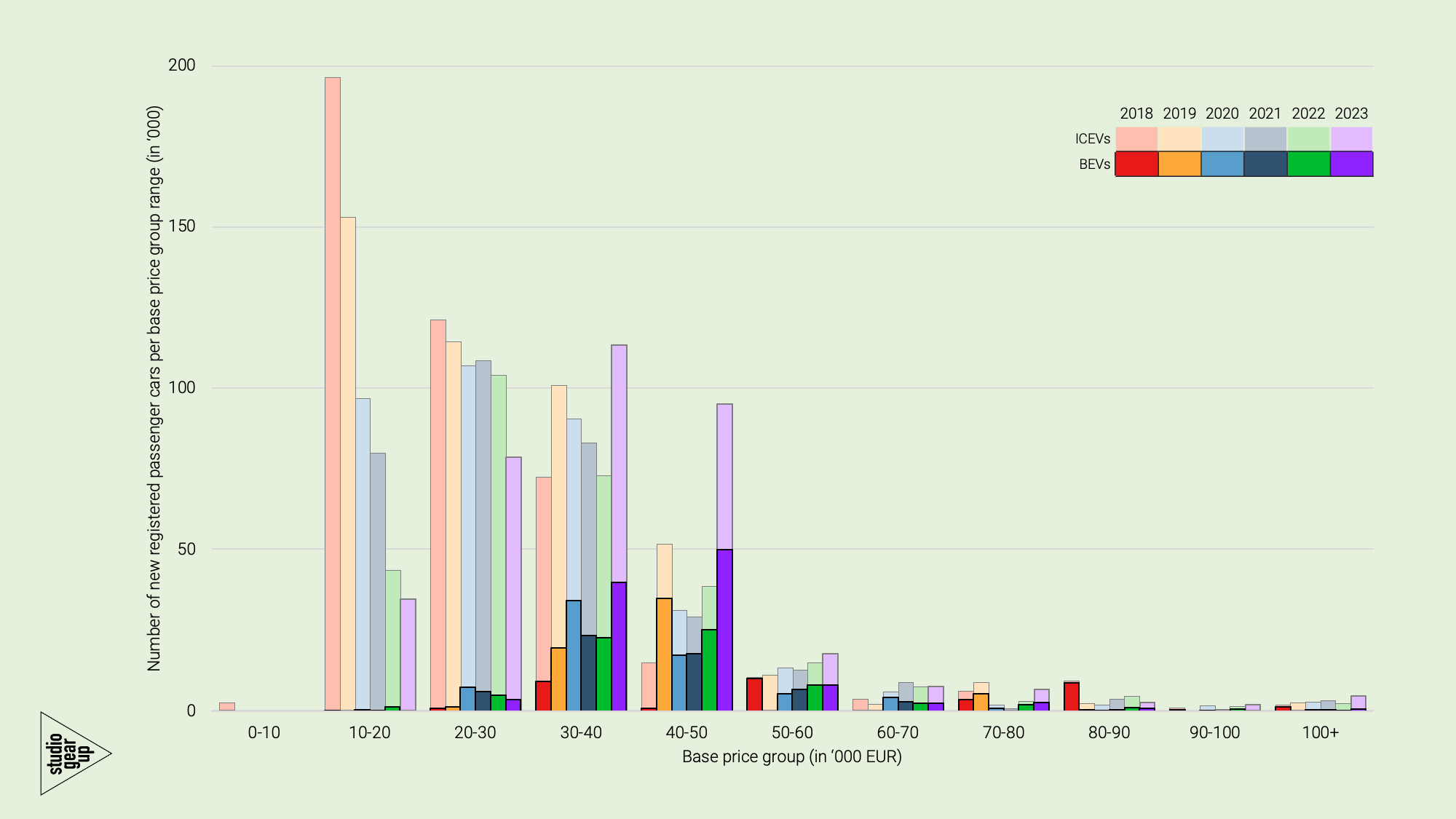

We have analysed all newly registered passenger cars in the time frame of 2018 to 2023 and, on basis of the base sales price (the lowest price for which a given model in those years could be purchased for). From that analyses we could see how much vehicles were register per price group: below 10 thousand euro (yes that occurred in 2018), between 10 and 20 thousand euro, between 20 and 0 thousand euro, and so on, up to the group with more than 100 thousand base sales price.

Figure 6 presents the results. Most striking to note is the starck reduction of registration volumes of lower cost models. In 2018, around 200 thousand vehicles were registered with a base sales price range of below 20 thousand euro, while in 2023 the volume in that price group declined to just 34 thousand. A similar development took place in the base sale price range between 20 and 30 thousand euro: from 121 thousand in 2018 to 79 thousand vehicle registrations in 2023 (see Figure 6).

Figure 6. New passenger car registrations per base sales price range group, 2018-2023. Source: RDW, RVO, Autoweek. Graph by studio Gear Up.

Another remarkable development is that over the years the price range category with the most registrations moved upward. 2018 and 2019 the 10-20 thousand euro group contained the most registrations, but in 2023 it is in the price range group of 30-40 thousand euro that showed the highest registration numbers. In 2023 the combined volume of registration of the 30-40 and the 40-50 thousand euro price range group was larger than the volume of the 10-20 thousand price range group volumes in 2018!

Zooming in on the registrations of BEVs, it is noted most are registered in the 40-50 thousand euro price range group. As we saw in Figure 1 and 2 that the total number of registrations of BEVs grew over time, but we do notice at the same time that the majority of sales are in the higher price range groups. The number of registrations in the 20-30 thousand euro price range group in 2023 declined for the third year in a row, indicating that the customers that buy new BEVs are not attracted to this sub segment of smaller and lower cost BEVs.

Future availability of attractive 2nd hand BEV models

The consequence of this new registration pattern in the Netherlands may be that in the near future just a limited number of BEVs will be available that would suit the 2nd hand market customers. One of the questions will be what will happen with the BEVs in the price range of 30-40 thousand and 40 thousand euro and above. Will they be priced attractively for the second hand buyers or not. The future will tell.

The announcements of several car manufacturers to bring B-class level BEVs to the market (such as the Citroen ëC3, Renault 5, VW ID.2, renewed Dacia Spring) that come at base prices of 25 thousand euro or less, contains promising perspectives for the emergence of a vivid 2nd hand BEV market. The coming period towards 2030 will be an important time to closely follow the actual developments.

Report

Find the pdf-report of this analysis here.

Notes and sources

Notes

[1] The analysis of the new registered passenger cars and the base-price information is based on several sources. See the list below. The assessment has been carried out for all newly purchased car models for which the number of registrations in 2023 on the Netherlands market were 100 or more. The total registrations of these vehicles accumulated to 370 thousand vehicles, which represented 98% of all new registered passenger cars (378 thousand) in the Netherlands in 2023. The base sales price is found via the Autoweek.nl website where for a given year the lower sales price for a vehicle model available in that year is selected

Sources

RDW: open database; RVO: monthly statistical reports; BOVAG: website with monthly and annual sales number, BOVAG/RAI Vereniging: detailed sales numbers of 2018-2023 distribution of ICEV, hybrids and full electric vehicles; Autoweek, website for model price information, Netherlands Statistics (CBS): passenger car fleet.